LS Value Maximizer, LLC (LSVM) offers a web based system that projected optimized minimum premiums of more than 1,200 life insurance policies associated with more than 100 products that are widely used in the life settlement market in order to maximize the value of life settlement policies.

Insurers in general do not provide minimum premium illustration for inforce policies. Investors often end up paying what the insurers require or excessive premium calculated by ignoring the applicable policy provisions. As a result, values of the policies are understated or inaccurate.

Ultimate minimum premium must be determined as the minimum amount required each month (or year or quarter) to support the policy based on policy provisions, prior premium history and recent illustration from the insurer.

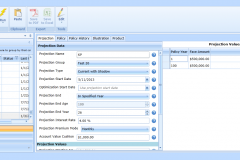

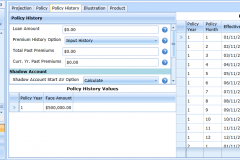

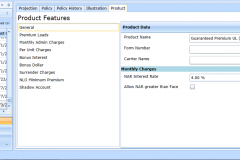

LSVM has designed and developed a system that calculates ultimate minimum premium for future remaining years of the life insurance policy. Our system accommodates contractual provisions attributable to lapse protection, various shadow accounts, riders and applicable endorsements. Our system uses a formula to solve for COI rates while relying on policy provisions pertaining to each individual policy. This system is available in a server and can be used by users who are registered to use the system.

Calculation of ultimate minimum premium is performed monthly or quarterly or annually. Front end screens would enable the users to easily project the ultimate minimum premiums. It is our understanding that all of our clients have benefited from our system in decreasing the minimum premiums solved by other systems and increasing the value of the portfolios.

Reliability

-LSVM system has successfully projected optimized premiums of more than 1,200 policies with various features such as shadow account value

– Actuarial consulting with respect to valuation

– Free initial training of system features as well as required insurance knowledge

Simple Interface

– You may easily download insurance illustrations

– Create and manage your own product library without any installation or additional infrastructure

High Performance

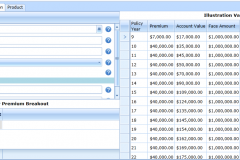

– Optimize monthly, quarterly and annual premiums instantaneously

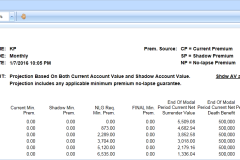

LSVM system solves and projects the optimized premiums based on policy provisions and accommodates secondary guarantees including various forms of shadow account values. The system enables the user to adhere to the applicable policy provisions. The screen shots of input and output are shown below:

Qualified Team

– Over 60 years of collective experience in life insurance

– Multiple industry-changing patents

LS Value Maximizer, LLC (LSVM) has extensive experience in assisting the buyers and sellers in the life settlement market by providing consulting and valuing policies and portfolios of policies as well as assistance with continued maintenance of portfolios of life settlement policies.

We have valued portfolio of policies utilizing our own methods with respect to (i) determining the applicable and reasonable set of mortality rates, (ii) developed methods to reconcile/modify medical underwriting rating based on available data from more than one LE providers and (iii) projecting minimum periodic premiums determined based on applicable policy provisions.

We have assisted buyers in formulating criteria to carefully select policies to be purchased with long term objective.

In addition to the current owners of LSVM, external actuarial resources are utilized from time to time based on projects undertaken by LSVM.